How to Maximize Real Estate Tax Benefits feat. Ryan Carriere

26 View

Share this Video

- Publish Date:

- October 3, 2024

- Category:

- Real Estate Investing

- Video License

- Standard License

- Imported From:

- Youtube

Tags

Ryan Carriere, co-host of the Tax Smart REI podcast and a Real Estate Tax Strategist at Hall CPA, explains the advantages and intricacies of real estate professional status and the short-term rental 'loophole,' highlighting strategies for both active and passive investors to optimize tax efficiency.

This podcast is sponsored by Aspen Funds. Alternative investments in Private Credit, Industrial Real Estate, and Oil and Gas:

Check out our latest offering in industrial real estate:

Our Private Credit fund:

Get in touch:

Download our FREE 2024 Economic Forecast:

Follow Aspen Funds

LinkedIn:

Instagram:

Facebook:

Connect with Ben Fraser

Connect with Ryan Carriere

00:00 Introduction

02:23 Meet Ryan Carriere of Hall CPA

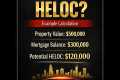

04:42 Understanding Real Estate Tax Benefits

07:32 Active vs. Passive Real Estate Investing

11:34 Strategies for Maximizing Tax Savings

18:33 The Hybrid Investor Approach

20:36 Balancing Tax Benefits and Family Dynamics

21:51 Real Estate Professional Status for Spouses

22:09 Household Perspective on Tax Benefits

26:31 The STR Loophole Explained

27:35 Material Participation Tests

33:15 Managing Short Term Rentals

35:06 Election Year Tax Implications

38:58 Conclusion and Contact Information

Read More

By: Invest Like a Billionaire

Title: How to Maximize Real Estate Tax Benefits feat. Ryan Carriere

Sourced From: www.youtube.com/watch?v=1WihHyvW984

_______________