How To Invest In Real Estate: The ULTIMATE Guide to Calculating Cashflow (EASY)

412,268 View

Share this Video

- Publish Date:

- September 23, 2024

- Category:

- Real Estate Investing

- Video License

- Standard License

- Imported From:

- Youtube

Tags

Here is EXACTLY how to calculate and analyze the cashflow of a rental property anytime you invest in real estate…and make as much passive income as possible! Enjoy! Add me on Instagram: GPStephan

70% OFF FOR A LIMITED TIME: The Real Estate Investing Blueprint - Complete Guide To Investing in Real Estate:

Join the private Real Estate Facebook Group:

Brandon Turner from Bigger Pockets video: Calculating Numbers on a Rental Property [Using The Four Square Method!]

This is probably THE MOST important step anytime you’re looking for an investment…this one single calculation tells you EVERYTHING you need to know about the property….it’s going to tell you how much money you’re going to make, it’ll tell you how much a property is worth, and it’ll tell you how much you should offer on the property to get your ideal ROI.

Anytime you’re evaluating a property, you’re going to have to calculate the GROSS INCOME. This is the TOTAL amount of income the property will be generating, BEFORE expenses.

In addition to rents, it’s important to calculate any other income that property generates.

For example, I’ve seen some properties that have laundry unit income

I’ve seen some that charge separately for storage.

Some that charge separately for parking.

Now we need to go to the next step: EXPENSES.

Anytime you own a property, you’re going to have FIXED EXPENSES NO MATTER WHAT - this means that even if you bought the property outright IN CASH, NO MORTGAGE, you’re still going to have these expenses…they’re fixed, and there’s no way around it.

These expenses include:

Property taxes - that’s unavoidable

Insurance - you better have insurance

If there’s an HOA - I don’t like HOA’s

If you pay utilities for the tenants - make sure they save water

Normal upkeep - like a gardener, pest control, etc.

Repairs that need to be done

If there’s any management fee

And vacancy when inevitably a tenant will move out and you’ll be missing out on that rental income

After that - we’ll need to calculate our NET RENTAL INCOME. Subtract EXPENSES by GROSS INCOME and this is your net income. From this, your can calculate your CAP RATE:

Divide the NET rental income by the purchase price, then multiply that by 100, and what you have left over is your percentage return.

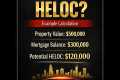

Next, we need to calculate the Mortgage Payment. Use to calculate your mortgage payment.

From there, subtract your mortgage payment from the NET RENTAL INCOME and that is your return!

But then we also have the RETURN ON EQUITY. Remember, every month you pay down your mortgage, part of that payment is interest on your loan balance, the other part is EQUITY towards paying down the loan…because remember, after 30 years, you’ll have no more mortgage and you’re owning this out right. So every month that goes by gets you closer to that goal.

In order to calculate how much equity you’re paying down, lets go back to MortgageCalculator.org, look under “calculate” where it says “show amortization schedule.” Then click “show annual amortization.” Then hit calculate.

So now, we add this back into our income, and that becomes your TOTAL ROI.

And that’s exactly how I calculate the cashflow of a property. With this entire formula, you can pretty much just plug in your own numbers and spit out the expected return!n!

For business or one-on-one real estate investing/real estate agent consulting inquiries, you can reach me at [email protected]

My ENTIRE Camera and Recording Equipment:

Favorite Credit Cards:

Chase Ink 100k Bonus Point Offer -

American Express Platinum -

Read More

By: Graham Stephan

Title: How To Invest In Real Estate: The ULTIMATE Guide to Calculating Cashflow (EASY)

Sourced From: www.youtube.com/watch?v=DgWcrsavcJs

_______________